Car Purchase Journal Entry

1Quantity 2 Rate per Kg 3 Excise Duty Direct or Input as such 4. 1When car purchase.

Financing New Company Vehicle Purchased With Trade In Of Old Vehicle General Discussion Sage 50 Accounting Canadian Edition Sage City Community

The payoff was 1315538 and we sold the.

. If you paid a deposit enter the payment and use the new vehicle fixed asset account as the expense for the payment. Take a minute to read How to Claim Input Tax Credits Relating to Business Use of Your Personal Vehicle. Enter the necessary information.

Journal Entry for Sale of a Vehicle with a loan. Subtract the two notes 44234 - 20658 23576. The entry to record the purchase at Jun 1 is as follows.

In case of a journal entry for cash purchase Cash account and Purchase. What are the correct journal entries for the sale of a vehicle with a loan. Debit vehicle for 20000.

Answer 1 of 3. Click on the Plus icon choose Check. When you purchase the car you make a journal entry for the purchase of a fixed asset on credit and more likely youll make several journal entries.

The monthly payment over 3 years is equal to 200. Credit Note Payable for 20000. At end of year to compute the interest you have to figure the amount of.

Depends on how the car was financed there are always variables DR Motor Vehicle DR Hire purchase Interest current asset CR Hire Purchase company I suspect this. One way is to record the expense by creating a check. Carfixed asset Dr total car value.

ABC has the option to trade in the old car for a discount of 20000 on a new car. Please journal entry for a trade-in vehicle. When you sell a company owned vehicle this decreases your Fixed Assets.

Let me guide you how. If you are not eligible to claim 100 of your vehicles GSTHST you include the tax as. The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense.

Answer 1 of 2. For this transaction the Accounting equation is shown in the following table. It is not the discount but the net off of old car value for a.

Cash via the checking account you use cash capital use Secondarilyyou may want to set up a depreciation account debit contra. Accounting and journal entry for credit purchase includes 2 accounts Creditor and Purchase. Could u pls tell me the entry of tcs1 when we purchase car in the name of firm.

Automobile fixed asset Credit. Before passing entries you need to cross check the purchase entry with invoice in following areas-. Go to the Company menu.

Let me show you how to enter a journal entry for the sale. In this case the net book value cost less accumulated depreciation of the fixed assets increases by. These car journal entries are for a vehicle costing 15000 and for a loan of 5 years at 12 with fortnightly payments calculated using the same Loan Amortization template mentioned.

Fixed Asset Trade In Double Entry Bookkeeping

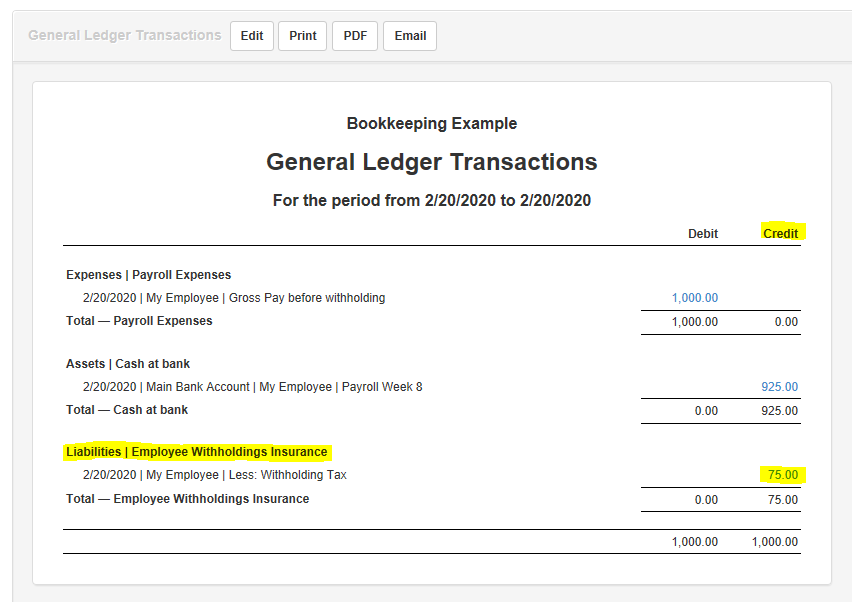

Solved Journal Entries For Fixed Asset Sale Vehicle With A Loan Liability

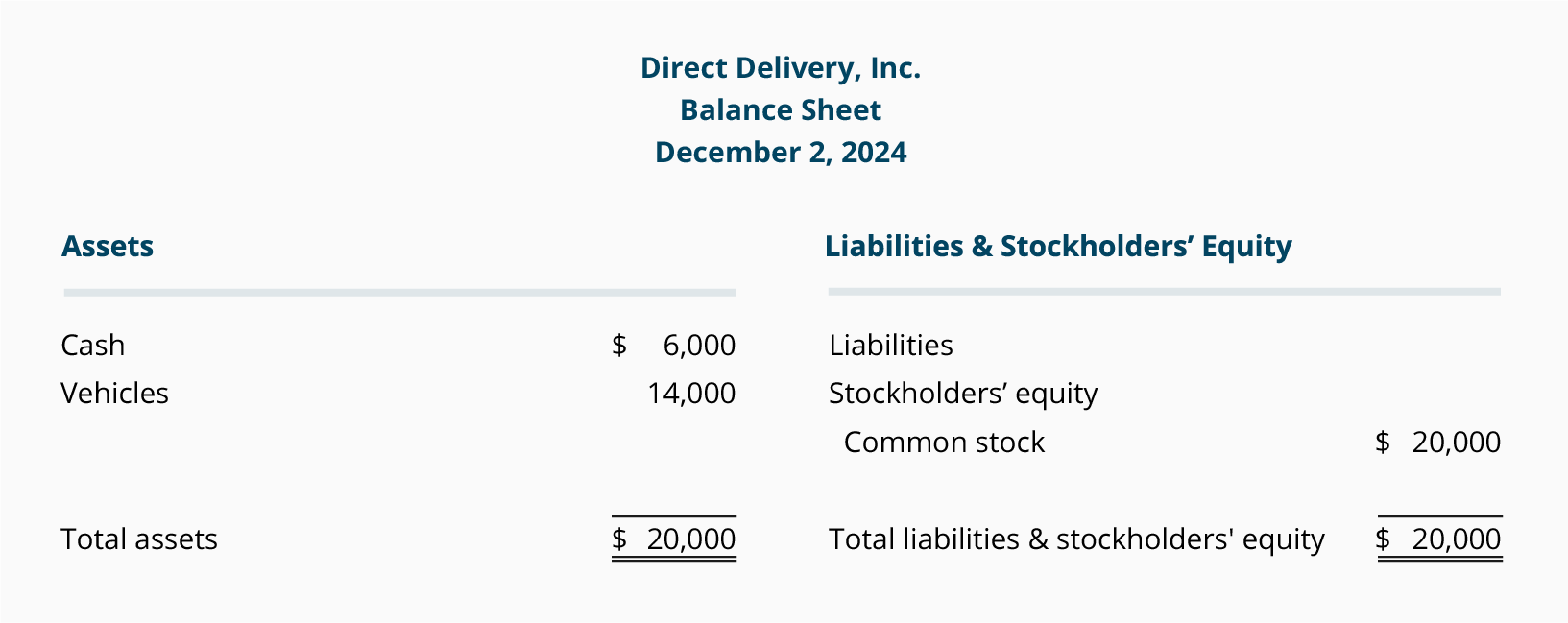

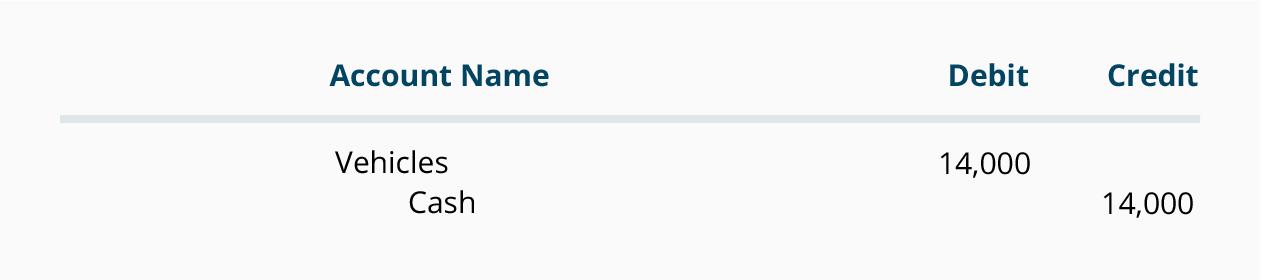

Accounting Basics Purchase Of Assets Accountingcoach

Financing New Company Vehicle Purchased With Trade In Of Old Vehicle General Discussion Sage 50 Accounting Canadian Edition Sage City Community

Comments

Post a Comment